A graduating high school student stares up at mounds of financial obligation, not knowing what to do or where to start. Graduating seniors often leave high school with little understanding of how to support themselves financially, so a required course that taught the importance of financial literacy would help students move into the real world safely and securely. “In low-income households, individuals may not have a wide range of accurate financial resources to learn from, thus making financial education more important in schools,” Editor-in-Chief Molly Harwell wrote. Illustration by Eleanor Robinson

A required course that teaches teenagers valuable financial skills would help CCHS students enter adulthood feeling confident and ready to support themselves monetarily.

With Clarke Central High School classes as advanced as Advanced Placement Calculus and as niche as mythology, it is surprising that the Clarke County School District has devalued financial education courses that should be essential to a teenager’s learning experience.

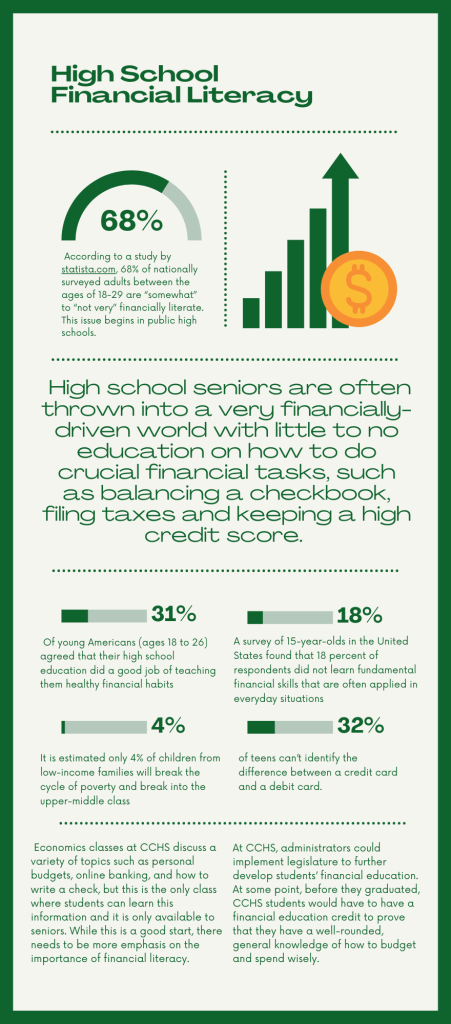

According to a study by Statista.com, 68% of nationally surveyed adults between the ages of 18- 29 are “somewhat” to “not very” financially literate. Public high schools are not preparing their students for the real world, especially in a financial sense.

“A 2016 survey indicated that only 31% of young Americans (ages 18 to 26) agreed that their high school education did a good job of teaching them healthy financial habits,” an article by Champlain College Online stated.

High school seniors are often thrown into the financially-driven world with little to no education on how to complete crucial financial tasks such as balancing a checkbook, filing taxes and establishing a high credit score.

Education is crucial when it comes to money. If students are educated on saving from a young age, they will be more fit to support themselves as they encounter financial issues.

“If you’re asking about the real world, I don’t know that a lot of our students are prepared because a lot of (financial skills) we don’t teach.”

— Dr. Summer Smith,

CCHS Associate Principal

“A survey of 15-year-olds in the United States found that 18 percent of respondents did not learn fundamental financial skills that are often applied in everyday situations, such as building a simple budget, comparison shopping and understanding an invoice,” a survey published by Youth.gov, a website dedicated to supporting and well-being of youth, stated.

Though administrators at CCHS have made some efforts to help students become financially independent through the economics courses offered, CCHS Associate Principal Dr. Summer Smith recognizes that a lack of practical education remains.

“If you’re asking about the real world, I don’t know that a lot of our students are prepared because a lot of (financial skills) we don’t teach — it’s all academic, right?” Smith said.

For example, On Level and Advanced Macroeconomics classes at CCHS touch on a variety of personal finance topics, such as personal budgets, online banking and how to write a check, but this is the only class that offers this information and it is only available to non-AP seniors.

An infographic shows statistics about financial literacy in young adults. While being financially capable is important throughout adult life, there are few opportunities for learning about money in the classroom. “High school seniors are often thrown into the financially-driven world with little to no education on how to complete crucial financial tasks such as balancing a checkbook, filing taxes and establishing a high credit score,” Editor-in-Chief Molly Harwell wrote. Graphic by Molly Harwell

While this is an important start, there needs to be more emphasis on the importance of financial literacy starting in ninth grade and for everyone at the school.

Another reason that financial education is crucial at CCHS today is because of the high poverty rate in Athens. With a poverty rate of 32.4%, Athens-Clarke County is one of the poorest counties in Georgia, according to an article by the Grady News Source of the University of Georgia.

In low-income households, individuals may not have a wide range of accurate financial resources to learn from, thus making financial education more important in schools.

“With such illiteracy, youth in low-income households can fall victim later as adults to scams, high-interest rate loans and increasing debt,” an article by Youth.gov stated.

One way to resolve this issue would be to implement a required course on financial literacy separate from Macroeconomics before graduation.

The Wisconsin State Assembly Education Committee is currently working to pass a bill for the 2022-23 school year that would institute a policy in high schools where students would have to complete a financial literacy credit in order to receive their diplomas, according to a Feb. 1 Wisconsin Public Radio article.

At CCHS, administrators should implement this legislature to further develop students’ financial education. With this change, CCHS students would have to have a financial education credit to prove that they have a well-rounded, general knowledge of how to budget and spend wisely.

Being financially literate is a vital part of post-secondary life, which can help students get jobs, gain skills in saving and march into the real world financially competent.